Secured Credit Cards

A secured credit card requires you to make a security deposit against the credit limit before you can be approved for the card. Your security deposit is placed in a savings account or certificate of deposit (CD) and kept there until your card is converted to an unsecured credit or until you default on the credit card (hopefully you never do).

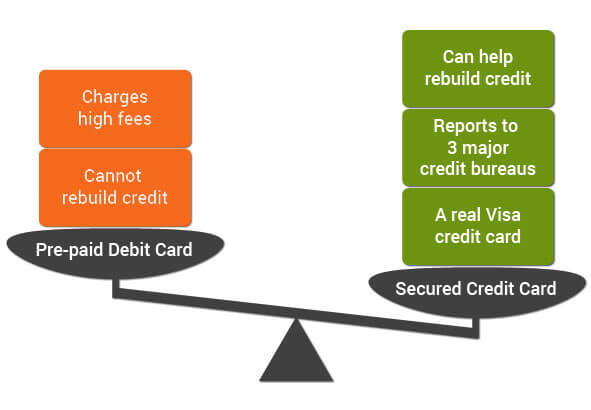

If you want to improve your credit score, a secured credit card is the best choice. Make sure you choose a secured credit card that reports to the three major credit bureaus which all of the credit cards that we offer below do report to all 3 credit bureaus. HAVING NEW POSITIVE LINES OF CREDIT WILL BE A VITAL PART OF RE-ESTABLISHING YOURSELF AS A QUALIFIED BORROWER.

Please click the “GET YOURS NOW” link below to apply for the card we recommend or you may review the other options below and pick one of you choice.

FREE CONSULTATION

please fill out the form below for your free consultation and a credit specialist will be in contact with you!