What Is A Credit Report?

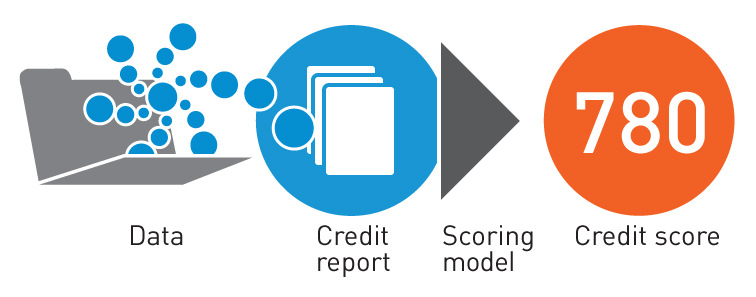

There are 3 major credit reporting bureaus, Transunion, Equifax, and Experian. Every Consumer has a different FICO credit score for all 3 credit bureaus. Your credit score is a 3-digit number gathered by a mathematical algorithm using the information in your credit reports. Its purpose is to predict risk, specifically, the likelihood that you will become seriously delinquent on your credit obligations in the 24 months after scoring.

FICO scores are based on a scale where a higher number indicates lower risk. Credit scores range from 300 to 850.

How Does Information Get On

My Credit Report?

The information in your credit report comes directly from companies that have extended you credit in the past or from those with which you have open accounts. Credit card companies, banks, credit unions, retailers, and auto and mortgage lenders all report the details of your credit activity to the credit reporting agencies (CRAs).

CRAs also receive information from debt collectors, and they purchase public records, such as bankruptcies, tax liens, and judgments, from public record providers.

Who Is Allowed To See My Credit Report?

With increased consumer awareness about the importance of a good credit score, regularly viewing a credit report, and the negative or positive impact that a credit score can have on your finances, it’s practical to want to know who else can see your credit score. Your credit score and credit report are snapshots of how you handle your affairs and key indicators of your risk to a lender. So who has the right to check your credit score?

Any people or organizations who have a “legitimate business need” can check your credit score. The phrase “legitimate business need” casts a broad net over who can access your credit score, and people and entities that fall under the category include:

1.) Current and prospective employers (with your consent)

2.) Child support enforcement agencies at the state and local levels

3.) Any government agency (how’s that for a broad net?)

4.) Landlords

5.) Credit card companies

6.) Mortgage and auto loan lenders

7.) Insurance companies

In short, anyone who’s considering extending credit of any kind to you can check your credit report and credit score.

ShowME Credit Solutions, LLC has 10 years of combined experience in the credit field and we have mastered how to examine a credit report for erroneous accounts. Once these erroneous accounts are found we will go to war to have these items corrected or deleted from your credit profile immediately! Removing these negative items that will be the first part of the credit repair process. During the credit repair process, we will also assist all clients in opening new lines of credit to start rebuilding good credit. WE ARE YOUR SOLUTION!!

FREE CONSULTATION

please fill out the form below for your free consultation and a credit specialist will be in contact with you!